Frequently Asked Questions

Question: We received a partial refund for an upfront deposit we paid to a supplier. When I went to record the deposit there wasn't a drop down menu to be able to credit against a job cost category. I was able to credit direct construction expenses but not the specific account.

How do I do that?

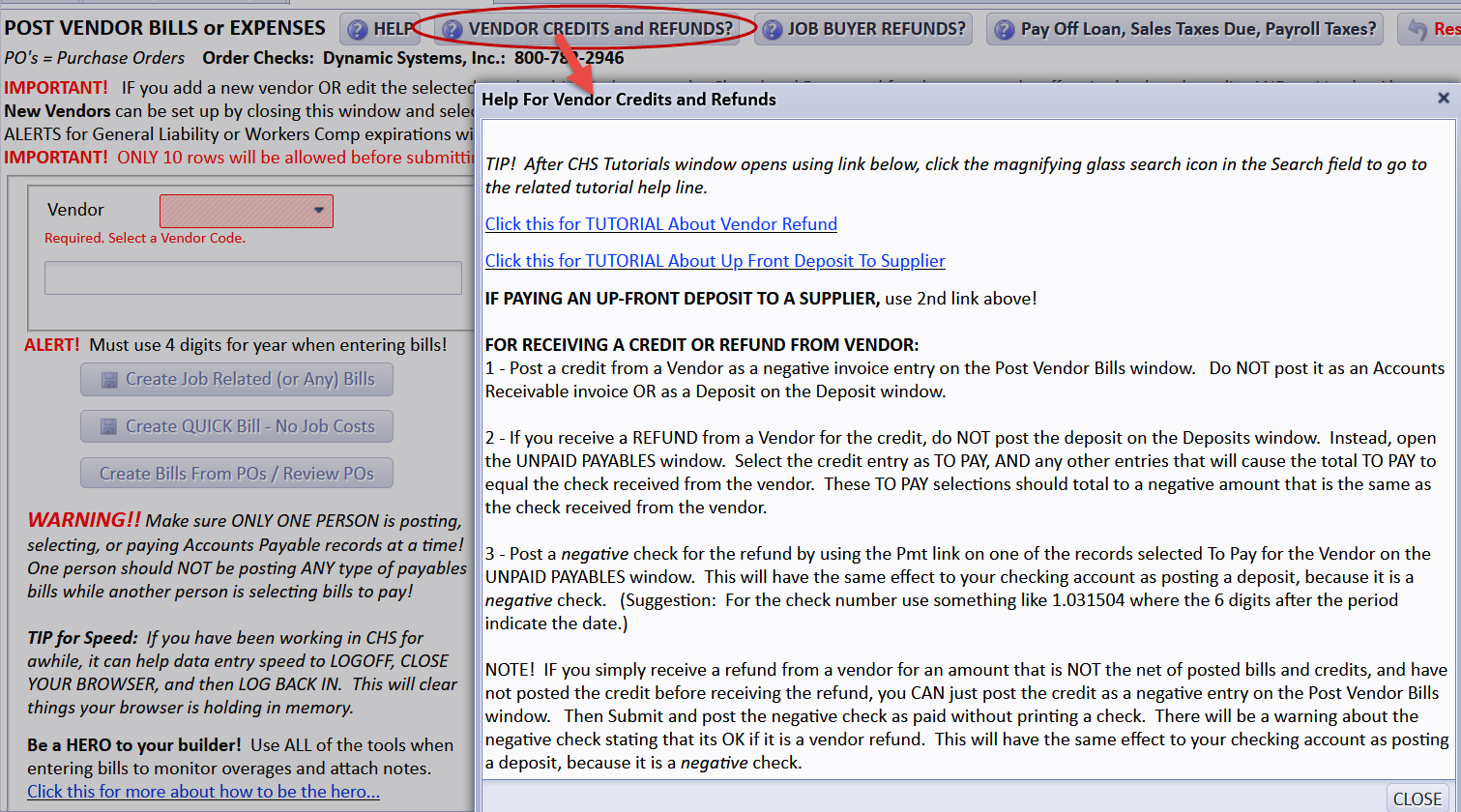

Answer:Look for button about vendor refunds at top of the window where you select a vendor for posting payables bills. Basically, post a negative payables bill and post the negative entry as paid. A ‘negative check’ will increase the cash account. Just an FYI, when posting a deposit, you can select Job Cost Credit OR Job Cost as the Deposit Category and a field will show for cost code selection. However, if it is a vendor refund it’s better to do the negative check thing in payables so it will be included on a vendor ledger for the vendor.

report vendor refund vendor credit refund credit partial refund negative check