Frequently Asked Questions

Question: I just opened a report and the data on the report is different than one I printed before, and I haven’t done anything to change it.

Answer:First, look at the dates printed on the bottom of the 2 report pages. Next, look at the Filters for each report and compare those. The filters may be at top or bottom of the whole report. If doing that doesn’t help figure it out, then somebody has probably added, edited, or deleted data that was included, or not, since the first report was printed. Try using the Audit table under Misc Utilities and search for audit records dated between the 2 report dates printed. You can use the Search button on the Audit window to search for audit records that might relate to data in your reports.

report report data is different

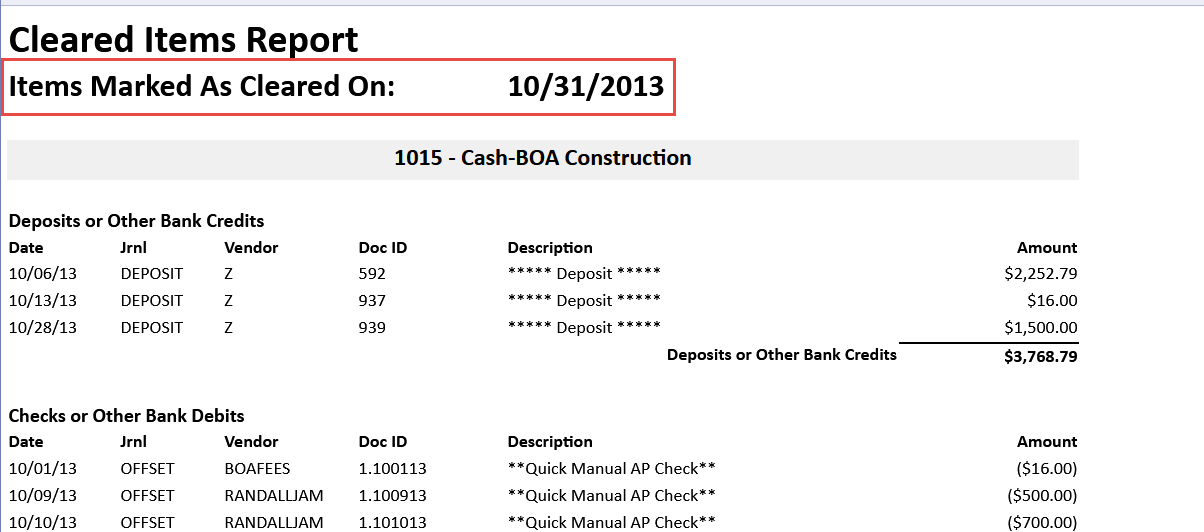

Question: Why is my bank reconciliation Cleared Items Report that I printed today for same bank statement month (or period) different than one I printed before?

Answer:First, you should always set your statement date to the bank statement’s end date before check marking items as cleared. The Cleared Items Report only shows records marked as cleared on one date.

Your issue could be that someone used 2 or more statement dates to check mark items as cleared during the statement period.

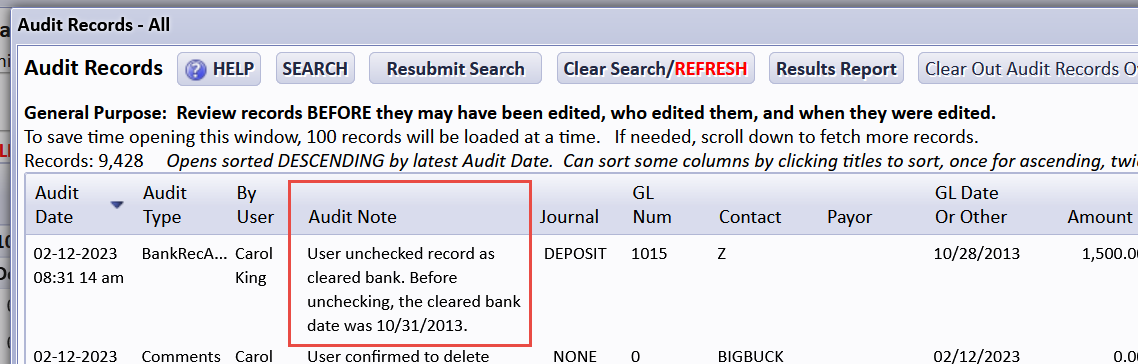

OR it could be that someone has checked or unchecked some items as cleared in that bank statement period. Note: An audit record is created when a user unchecks an item that was previously marked as cleared.

report Cleared Items Report Bank Reconciliation

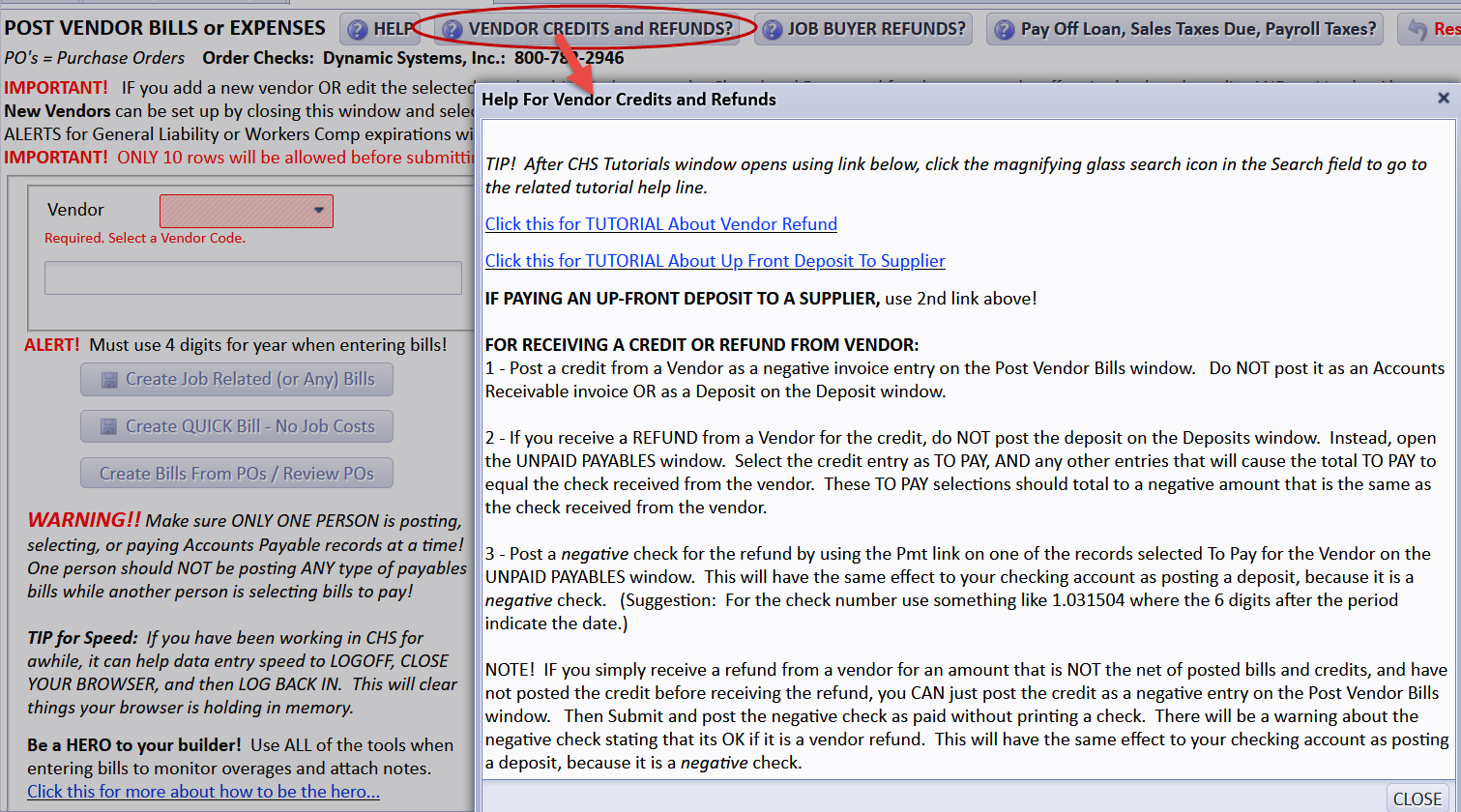

Question: We received a partial refund for an upfront deposit we paid to a supplier. When I went to record the deposit there wasn't a drop down menu to be able to credit against a job cost category. I was able to credit direct construction expenses but not the specific account.

How do I do that?

Answer:Look for button about vendor refunds at top of the window where you select a vendor for posting payables bills. Basically, post a negative payables bill and post the negative entry as paid. A ‘negative check’ will increase the cash account. Just an FYI, when posting a deposit, you can select Job Cost Credit OR Job Cost as the Deposit Category and a field will show for cost code selection. However, if it is a vendor refund it’s better to do the negative check thing in payables so it will be included on a vendor ledger for the vendor.

report vendor refund vendor credit refund credit partial refund negative check