Frequently Asked Questions

Question: How do I resolve the insecure download when exporting reports?

Answer:Please see the attached document that outlines the steps for Chrome, Firefox and Microsoft Edge.

Question: How do I post credit card receipts that are not job related?

Answer:First, you need to enter the charge to a vendor, like GAS, that a lot of people use, not to a credit card vendor. The GAS vendor might have a default GL account that is where a gas expense should be posted. Then submit it and select Post As Paid By Credit Card, and that’s when you select your Credit Card.

Tip: I have vendors in my books called RESTAURANTS, LODGING, GAS, etc.

You don’t post a credit card charge directly to the credit card vendor. If you pay the lumber company with a credit card, you post the charge to the lumber company vendor, and THEN submit that and select to post it as paid by credit card.

‘Credit Card Vendors’ will be hard coded by CHS to default to the credit card payable GL account that you associated it with on your Chart Of Accounts. The only new payables bill that you post directly to a credit card vendor is a total payment to pay down the credit card.

Also, sounds like you might need to set up a new credit card vendor AND a credit card payable account on your chart of accounts.

setup credit card accounts post credit card receipts

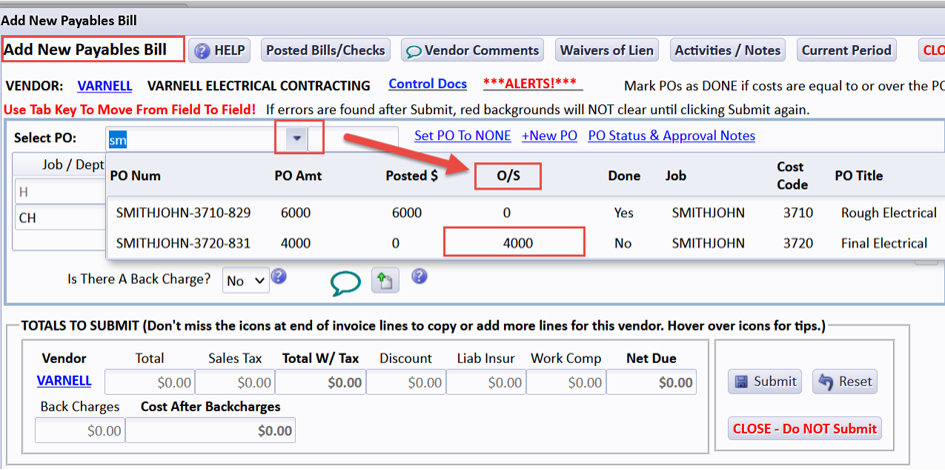

Question: How do i apply an invoice against a PO?

Answer:If you are just entering a brand new invoice, and have already created a PO for that cost, then when you enter the invoice, you simply select the PO to use by starting to type in the job code in the Select PO field, and a lot of the fields for the new bill will fill in for you:

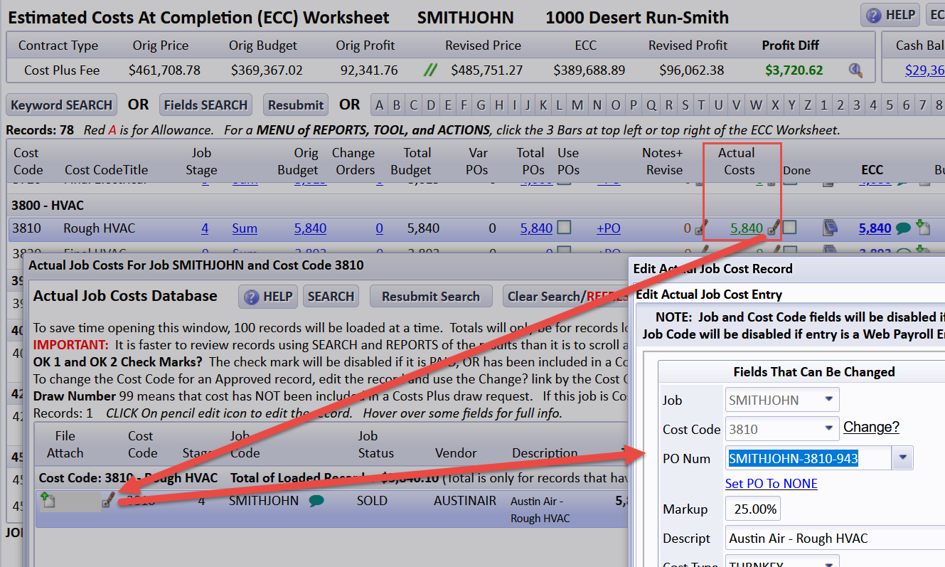

If the job cost invoice has already been entered into Payables, AND you have already created a PO for that cost, then you can edit the actual job cost record and attach the PO to it from several places where you can drill down to the actual job records… like from the ECC worksheet, the POs and Costs Management, the Actual Job Costs Database, or from lists of vendor bills. On any of those, there will be a pencil edit icon for the job cost record that allows you to edit it and select a PO with the same Vendor, Job, and Cost Code. I opened the one below by drilling down using the pencil edit icon for the Actual Costs for a cost code on the ECC worksheet.

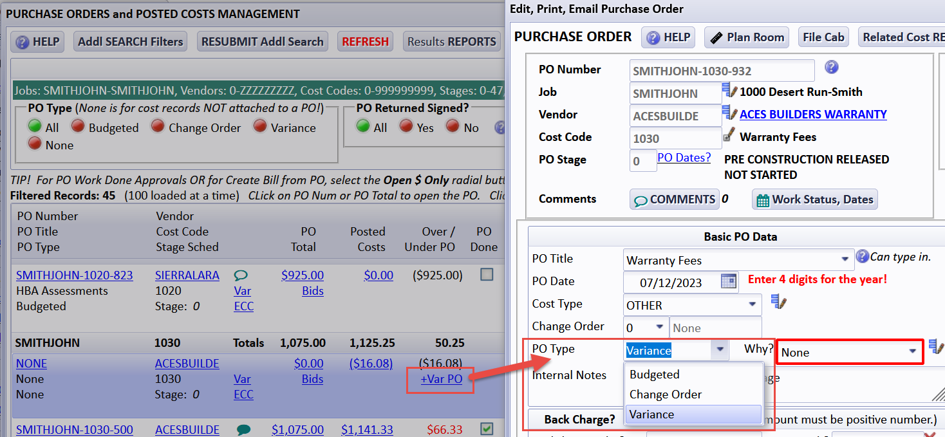

Question: We are running into an issue - we are putting in purchase orders for main bids, but then there are always going to be miscellaneous additional costs in most cost codes that are additional/outside of the original purchase order. However, when we make them a Variable PO, it doesn't add up right. The variable PO amount is based on budget. But our main PO's aren't always the same amount as the budget, so it gets confusing.

Is there functionality where we could just create a normal PO for posted costs without a PO (with the click of a button, just like the Var PO button)? We want the Purchase Order total to increase when we add those miscellaneous items, so the ECC is accurately reflected.

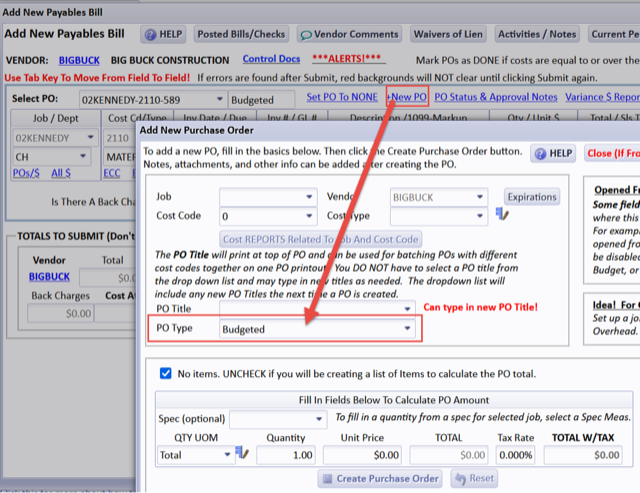

Answer:When you click the +Var PO link on the Purchase Orders and Posted Costs Management window, and the new PO window opens, you can change the PO Type to Budgeted, and not Variance. OR farther down, when the cost is being entered on the Add New Payables Bill window you can click the +New PO link and a window will open to add a new PO that default the Budgeted po type.

PO Type budgeted PO variance po purchase orders incremental POs

Question: How do I delete a job from CHS?

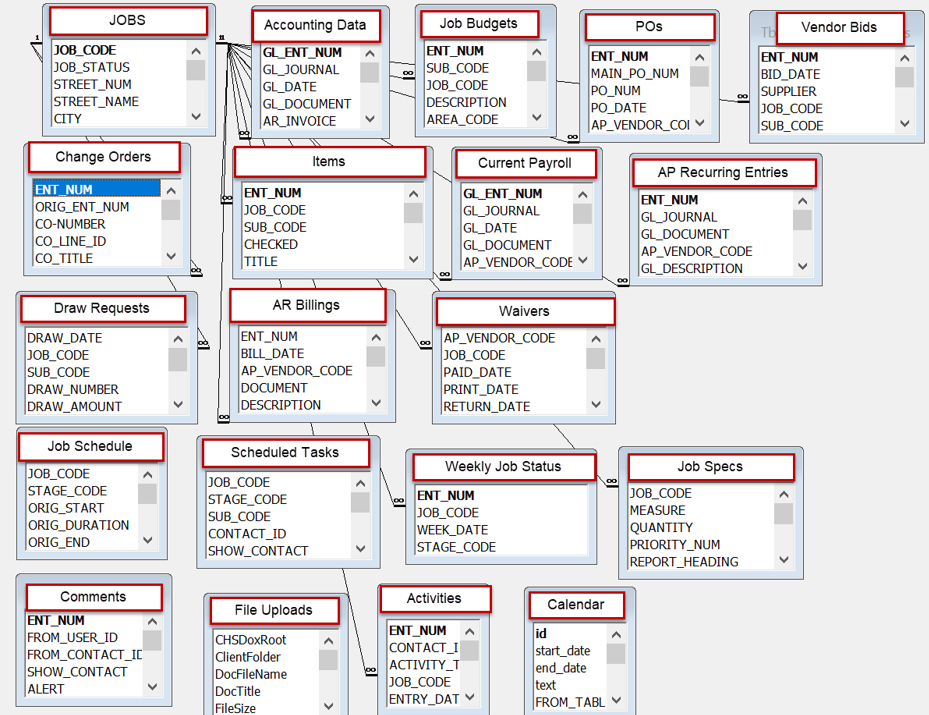

Answer:See diagram below for a list of tables in CHS that use a job code. All of these are required in a ‘relational’ database to produce a powerful job costing program. So, if a job is used in any one of these tables, it cannot be deleted without basically breaking the program. The first step is to purge your accounting records as of a selected date to get a job removed from your accounting books. Next steps are to remove budgets, POs, Vendor Bids, Change Orders, Draw Requests, Waivers etc., etc. for old jobs.

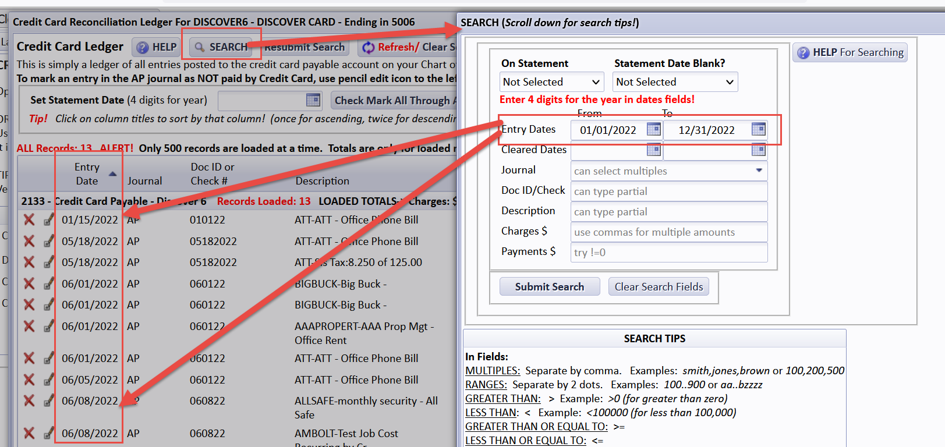

Question: How do I find credit card entries when doing a credit card reconciliation?

Answer:There is a SEARCH button on the window of credit card records. It will help you narrow down the list of records to a selected range of dates.

There is a SEARCH button on the window of credit card records. It will help you to narrow down the list of records to a selected range of dates.

credit card entries credit card reconciliation

Question: I am trying to import payables bills and am getting this error:

Upload status: 500 – Server Returned An Error.

Answer:The file format does not match the .xls or .xlsx file type.

The file to import must be from an Excel file with the extension .xls or .xlsx.

If you have saved it with one of those extensions, but somehow converted it to a csv or some other file format, you will get this error.

Import Payables Import Bills Upload Status: 500 Server Returned an Error 500 500 Error

Question: We entered our Balances Forward from our Trial Balance from old software. But now our CPA has given us adjustments which changes our balances forward. And we’ve already started entering current year data. Where do we enter the adjustments? Do we make a journal entry?

Answer:Go back to the Chart Of Accounts window and simply edit your balances forward.

Since it is your Balances Forward for starting with CHS, you do not need to go make a journal entry.

At the end of current year and future years, if your CPA gives you adjustments at year end, you WOULD do those as a journal entry.

Chart of Accounts Balances Forward Adjustments

Question: I just opened a report and the data on the report is different than one I printed before, and I haven’t done anything to change it.

Answer:First, look at the dates printed on the bottom of the 2 report pages. Next, look at the Filters for each report and compare those. The filters may be at top or bottom of the whole report. If doing that doesn’t help figure it out, then somebody has probably added, edited, or deleted data that was included, or not, since the first report was printed. Try using the Audit table under Misc Utilities and search for audit records dated between the 2 report dates printed. You can use the Search button on the Audit window to search for audit records that might relate to data in your reports.

report report data is different

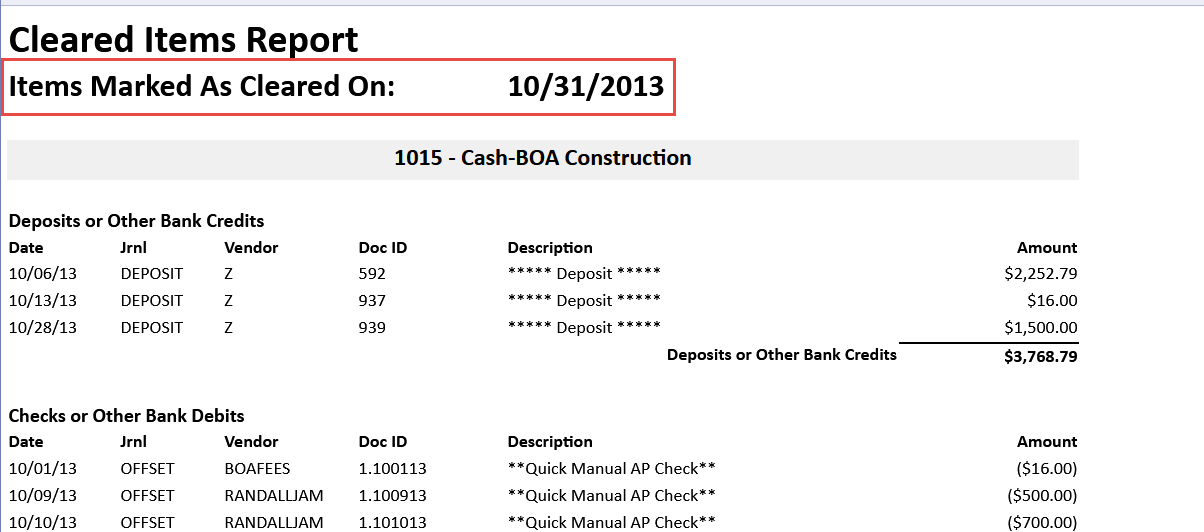

Question: Why is my bank reconciliation Cleared Items Report that I printed today for same bank statement month (or period) different than one I printed before?

Answer:First, you should always set your statement date to the bank statement’s end date before check marking items as cleared. The Cleared Items Report only shows records marked as cleared on one date.

Your issue could be that someone used 2 or more statement dates to check mark items as cleared during the statement period.

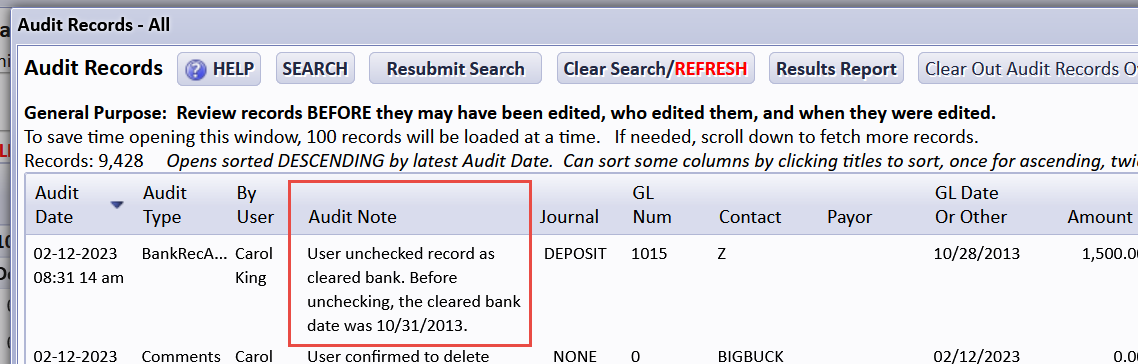

OR it could be that someone has checked or unchecked some items as cleared in that bank statement period. Note: An audit record is created when a user unchecks an item that was previously marked as cleared.

report Cleared Items Report Bank Reconciliation